You’ve done everything right. You’ve got car insurance, you drive responsibly, and you even wave when someone lets you merge. But what happens when the other driver doesn’t play by the same rules?

Imagine this: you’re in a wreck, and it’s clearly the other driver’s fault. You assume their insurance will cover the damages and medical bills, right?

Not so fast.

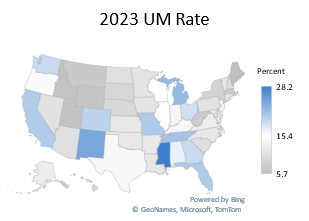

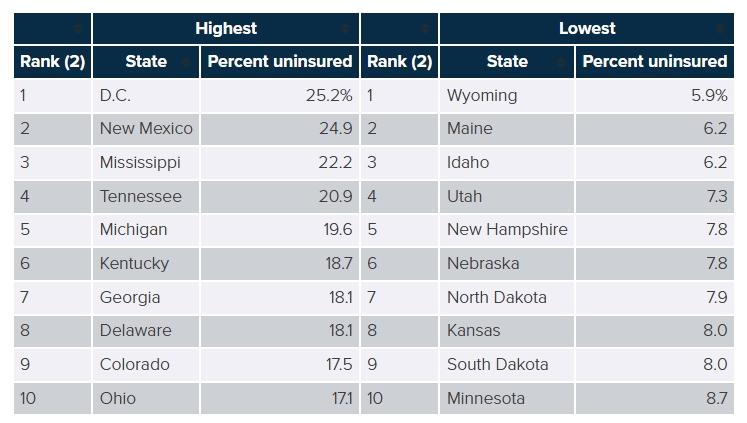

According to the Insurance Research Council, about 1 in 8 drivers in the United States have no insurance at all. In Georgia, that number is similarly concerning, with roughly 12% of drivers uninsured as of the latest data.

In fact, Georgia has consistently been ranked in the top ten amongst states with the highest uninsured motorist drivers on the road.

Even if the driver who hits you does have insurance, Georgia’s state minimum liability limits—currently $25,000 per person and $50,000 per accident for bodily injury, and $25,000 for property damage are woefully inadequate in today’s world. Just one emergency room visit can cost you thousands of dollars!

That’s where Uninsured and Underinsured Motorist Coverage (UM/UIM) can become your financial superhero.

- UM (Uninsured Motorist) coverage steps in when the at-fault driver has no insurance at all.

- UIM (Underinsured Motorist) coverage kicks in when the at-fault driver’s policy limits aren’t high enough to cover your injuries, damages, or lost wages.

Even better, this coverage does not only protect you, but it also protects your passengers. Interestingly, UM/UIM can often even cover you if you’re hit as a pedestrian or cyclist.

But here’s a crucial detail many drivers don’t realize:

Your UM/UIM limits usually can’t be higher than your auto liability limits. So, if you carry low liability limits to save a few bucks, you’re also capping the amount of protection you have for yourself. It’s like locking the front door but leaving the back door wide open.

That’s why increasing your auto liability limits isn’t just about protecting others—it’s about protecting you. Many insurance professionals consider this one of the most important steps you can take in building a truly protective policy.

So ask yourself:

Would you trust a complete stranger with your finances… or your spine?

The answer is probably no.

Call your insurance agent today and ask about the cost to increase your UM/UIM limits. If you do not have an agent, do not hesitate to contact me. You might be surprised to find that the added protection costs far less than you think—and could save you from devastating financial fallout.

Because the minimum is not enough.

Drive safe and stay protected!

Authored by: Brandon A. Carlson, CWCA